SDG Investing

ESG Algorithms for choosing stocks are usually based on a screening approach based on the business model and the data from the past. This makes share selection based on ex-post data. The investor takes the entire universe and decides according to his ESG approach whether he /she wants to pursue an ESG integration approach, exclusion lists, an ESG engagement and voting strategy, norms based screening or opportunity recognition based screening. Namely, starting from all possible stocks, stocks are filtered out when they do not fulfill certain desired characteristics or prove to be not responsive ot the engagement and voting strategy.

However, none of the screening strategies known from the prior art is capable of providing an investment universe based on the 17 Sustainable Development Goals including criteria that result from matching the companies results based on a SDG screening radar and a Theory of Change. We use the patented technology from Eccos Impact GmbH for creating your investment universe based on

- opportunity recognition

- SDG alignment and/or

- EU Taxonomy Compliance

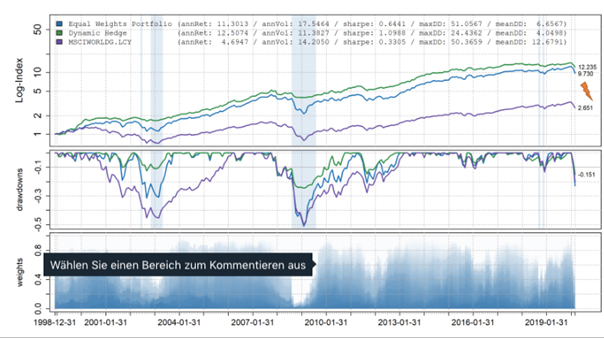

The results show that SDG investing performs at least at par with the MSCI. Please contact us now to get your SDG Investment Strategy.

Call us now: +41415613854